MPs Back Mthuli Ncube’s Sports Betting Tax Proposal: A Strategic Move for National Development

Introduction

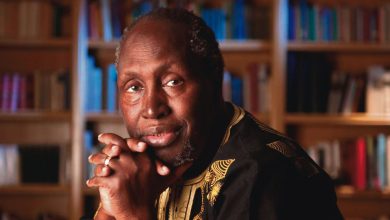

Finance Minister Mthuli Ncube’s proposal to introduce a 10% withholding tax on gross sports betting winnings has received robust support from Zimbabwean MPs across party lines. This initiative, outlined in the 2025 budget, seeks to harness revenue from a burgeoning sports betting sector, with the objective of investing in national sports infrastructure and youth development

Why the Proposal Matters

Zimbabwe’s sports betting industry has seen exponential growth over the past few years, with numerous betting houses popping up across urban and rural areas. Currently, winnings in this sector remain untaxed, a loophole that has hindered the government’s ability to leverage this lucrative market for national development. Minister Mthuli Ncube’s proposal aims to address this gap by including bettors in the tax base

Ncube emphasized during the budget presentation, “It is only fair that the betting sector contributes significantly to the fiscus, given its widespread popularity and profitability in our economy.” The proposed 10% withholding tax is seen as a strategic step to generate substantial revenue that would be channelled into critical areas such as sports infrastructure, athlete welfare, and youth academies

Recommendations for a Dedicated Sports Development Fund

During a post-budget analysis session, members of the parliamentary portfolio committee on sports and recreation rallied behind Ncube’s tax proposal. Albert Mavunga, the MP for Nketa, highlighted the necessity of setting up a Sports Betting Tax Fund. He recommended that the fund be ring-fenced, ensuring the 10% sports betting revenues are exclusively directed toward sports development initiatives

“This fund would help improve sports facilities across the country, support athletes financially, and establish youth academies that nurture upcoming talent,” said Mavunga. Such investments aim to build better infrastructure, which would enable teams to play home games locally rather than relying on facilities in neighbouring countries

Addressing Youth Unemployment and Social Challenges

Gladys Hlatshwayo, an opposition MP, also voiced support for the tax while expressing concerns about the social implications of sports betting among unemployed youths. She pointed out that many young people turn to betting out of desperation, seeking quick gains in an environment where job opportunities are scarce

She further highlighted the inefficiencies in ring-fenced funds from past initiatives like the sugar tax, carbon tax, and tobacco tax, which were not always deployed for their intended purposes

Hlatshwayo advocated for greater transparency and accountability in managing funds generated through the proposed sports betting tax, ensuring that revenues genuinely contribute to sports development and social empowerment.

Future Flexibility in Tax Policies

Finance Minister Mthuli Ncube also assured MPs that the withholding tax policy is open to revision. “We are flexible and willing to review our policies. We will listen to feedback and make necessary adjustments,” Ncube stated

This adaptability allows the government to refine the tax system as it evaluates the financial impact and effectiveness of sports investments.

Conclusion

Parliamentarians have shown bipartisan support for Minister Mthuli Ncube’s proposal to tax sports betting winnings, viewing it as a crucial step toward sports development and infrastructure enhancement. The 10% withholding tax is expected to generate significant revenue, with calls for a dedicated Sports Betting Tax Fund ensuring targeted investments. While challenges remain, particularly in ensuring transparency and accountability, this initiative promises to build a robust sports infrastructure and empower the youth through sports academies and athlete support systems.