In a significant policy shift, Zimbabwe’s President Emmerson Mnangagwa has repealed Statutory Instrument (SI) 81A of 2024 through the enactment of SI 134 of 2025. This move eliminates penalties for businesses pricing goods above the official exchange rate, marking a pivotal step towards aligning the nation’s economy with market realities.

Embracing Market Dynamics

The repeal of SI 81A removes constraints that previously forced formal businesses to adhere to an overvalued official exchange rate, often pushing them towards the informal economy. By acknowledging the distortions caused by rigid price controls, the government aims to foster a more transparent and efficient market environment.

Kipson Gundani, CEO of the CEO Africa Roundtable, lauded the decision, stating, “Policymakers have no business dictating prices unless there are market failures. Removing this distortion should boost formal trade.”

Rebuilding Confidence in the ZiG

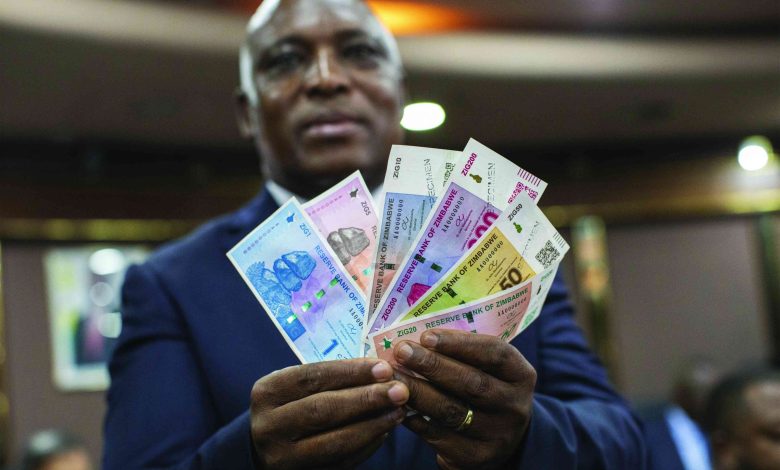

The introduction of the gold-backed Zimbabwe Gold (ZiG) currency in April 2024 was met with challenges, including a significant depreciation on the black market. The disparity between the official and parallel exchange rates led to supply chain disruptions and a shift in consumer preference towards informal markets.

The government’s decision to liberalize pricing is seen as a move to restore confidence in the ZiG. Persistence Gwanyanya, a member of the Reserve Bank of Zimbabwe’s Monetary Policy Committee, emphasized the government’s commitment to economic liberalization: “The Government has listened to businesses. We’ve now freed the market to promote stability.”

Broader Economic Reforms

The repeal of SI 81A is part of a broader strategy to stabilize Zimbabwe’s economy. The Reserve Bank of Zimbabwe has introduced measures such as increasing interest rates on savings and time deposits and eliminating transaction charges for small-value transactions to promote the use of the ZiG.

Additionally, the government has extended the multi-currency system’s tenure to 2030, providing businesses with a more predictable economic environment.

Looking Ahead

While challenges remain, the government’s willingness to implement market-driven reforms signals a commitment to economic recovery. By addressing the concerns of the business community and taking steps to stabilize the currency, Zimbabwe is laying the groundwork for a more resilient and investor-friendly economy.