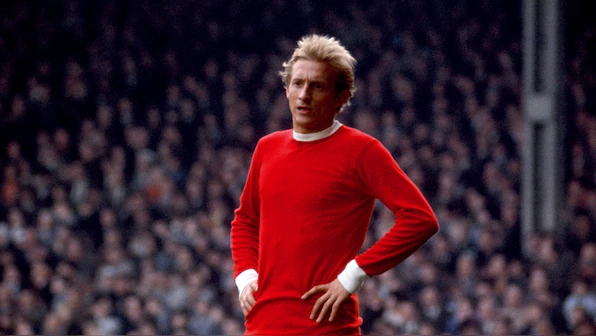

Denis Law: Manchester United and Scotland Football Legend Passes Away at 84

Denis Law, the legendary Scottish footballer renowned for his prolific career with Manchester United and as Scotland’s joint-record goalscorer, has passed away at the age of 84.

Early Life and Career Beginnings

Born on February 24, 1940, in Aberdeen, Scotland, Denis Law was the youngest of seven children. Despite early health challenges, including a severe squint, he began his football journey with Huddersfield Town in 1956.

Record-Breaking Transfers and European Ventures

In 1960, Law moved to Manchester City for a British record fee of £55,000. His talent soon attracted international attention, leading to a transfer to Torino in Italy for £110,000, setting a new record for a British player moving abroad.

Manchester United Triumphs

Returning to England in 1962, Law joined Manchester United, where he became an integral part of the team’s “Holy Trinity” alongside George Best and Sir Bobby Charlton. Over 11 seasons, he scored 237 goals in 404 appearances, making him the club’s third-highest scorer. His contributions were pivotal in securing two league titles, an FA Cup, and the 1968 European Cup, although a knee injury prevented his participation in the final.

International Achievements

On the international stage, Law earned 55 caps for Scotland, netting 30 goals—a record he shares with Kenny Dalglish. He represented Scotland in the 1974 World Cup, further cementing his status as a national icon.

Later Years and Legacy

After a brief return to Manchester City, Law retired from professional football. In 2002, he was honored with a statue at Old Trafford, commemorating his contributions to the club. In 2021, Law publicly revealed his diagnosis with Alzheimer’s and vascular dementia. His family expressed gratitude for the support received, stating, “We know how much people supported and loved him and that love was always appreciated and made the difference.”

Tributes and Remembrance

Manchester United paid homage to their legend, stating, “He will always be celebrated as one of the club’s greatest and most beloved players.” The Scotland national team also honored him, calling Law “a true great” and adding, “We will not see his likes again.”